CARES Act Provisions allow for Increased Refund Potential.

It's True! Find out if the CARES act can help you!

SEC. 2203 of the CARES Act details modifications for (1) net operating losses including the temporary repeal of taxable income limitation and (2) the modification of rules relating to carrybacks. In short, this legislation loosens rules governing net operating loss deductions (NOLs), providing much-needed relief for businesses and opening doors for opportunity.

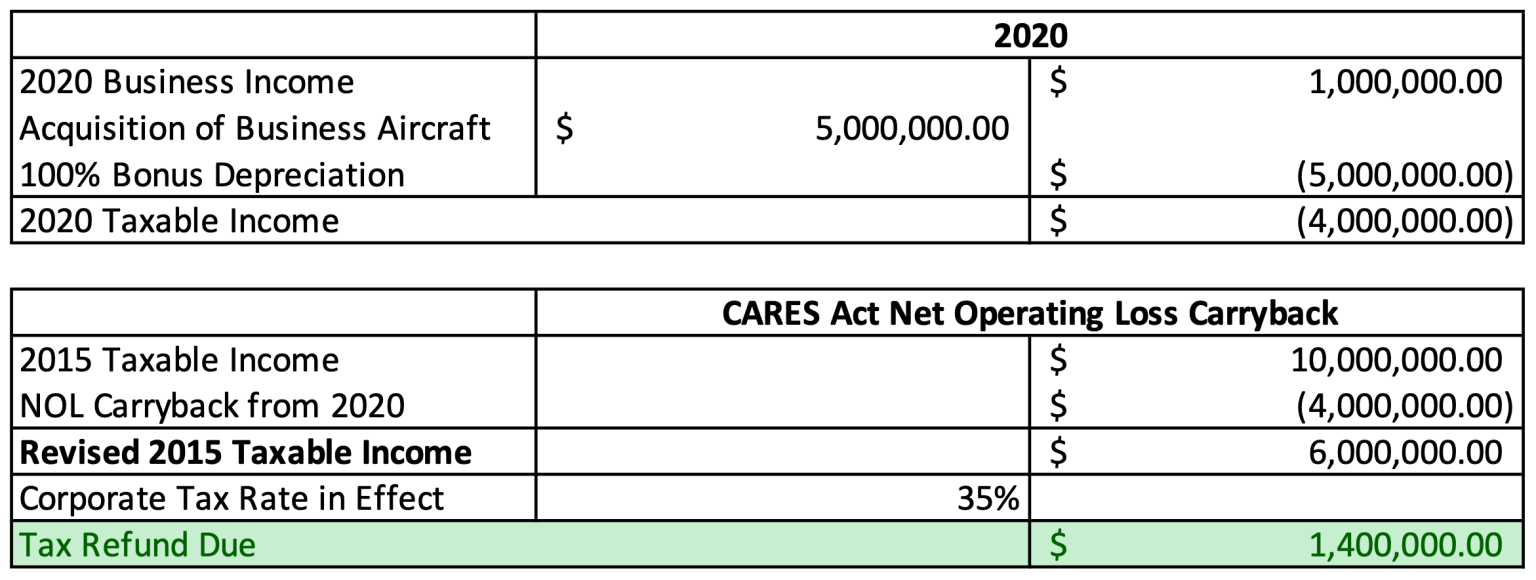

Let’s walk through this simple illustration by Daniel Cheung, CPA, who is a principal of Aviation Tax Consultants, LLC (ATC).

Your company (C corporation) has net income of $1,000,000 in 2020. You are considering the purchase of a $5,000,000 business aircraft to help manage and grow your business. Assuming 100% business use of the aircraft for 2020, you will be allowed a $5,000,000 depreciation deduction on the aircraft. The resulting tax loss is $(4,000,000). The Act allows this loss to be carried back to tax year 2015 and applied against your 2015 taxable income. This will result in a reduction of $(4,000,000) in 2015 taxable income, which is a tax refund of $1,400,000 at the federal corporate tax rate of 35%. If the loss is not fully absorbed by 2015 income, the remaining loss can be carried to 2016, 2017 tax years, etc, until fully absorbed by prior year taxable income.

With the law going back to 2015, businesses can recapture taxes paid from those higher tax years. The same holds true for pass-through business owners (S Corporation or LLC).